Paper Trading

Are you new to crypto trading and looking for a way to test your strategies without risking real money?

Look no further than our paper trading feature.

Enjoy Your Free Forever Paper Trading Plan

You can learn and test your strategies risk-free with the Free Paper Trading Plan.

LEARN TRADING

Learn Trading Properly with Paper Trading

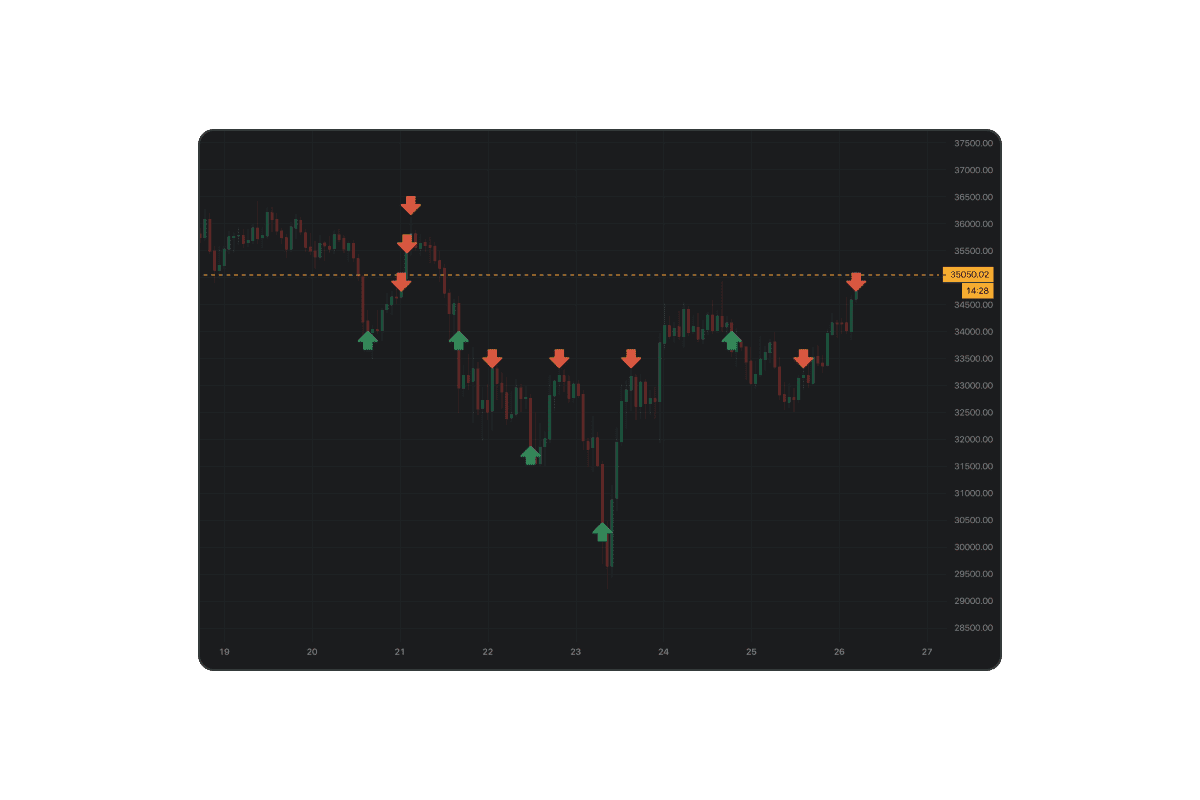

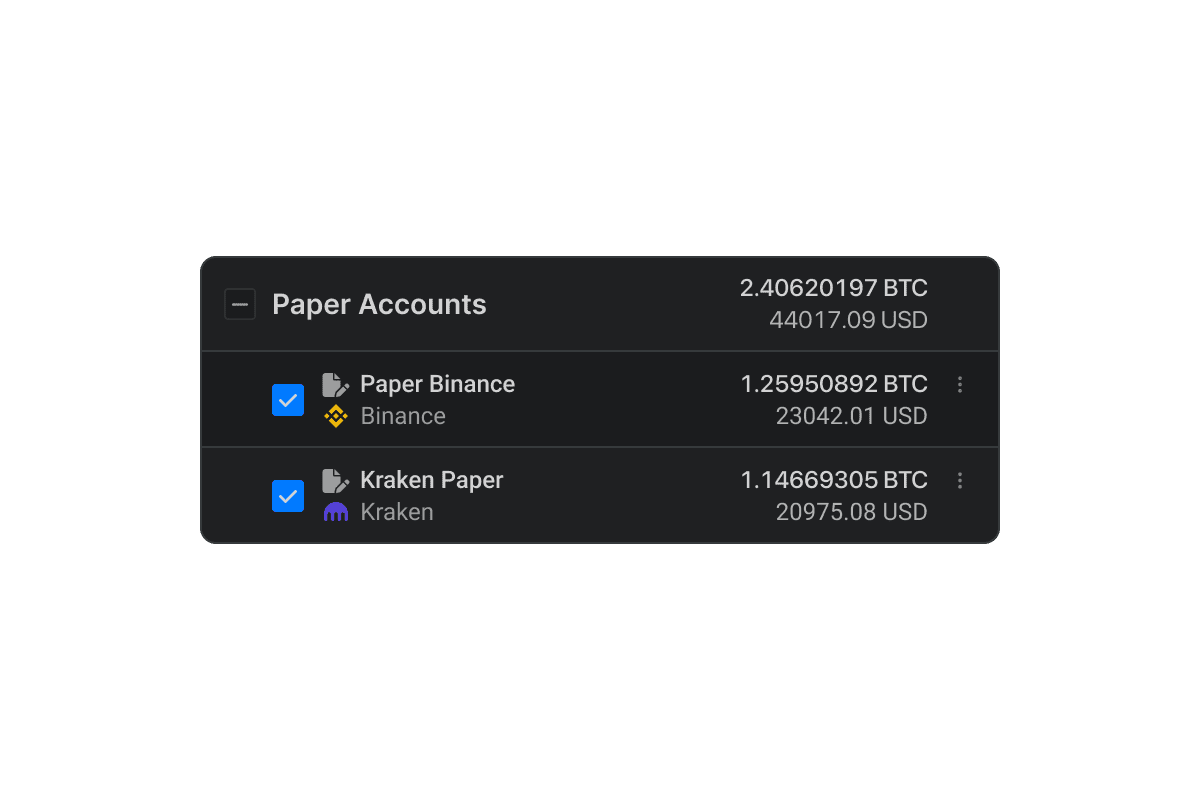

With paper trading, you can simulate the trading experience using virtual coins.

As a result, paper trading allows you to test different strategies, try new ideas, and gain valuable experience without risking your own money.

RISK-FREE

Experience Market Without the Risk

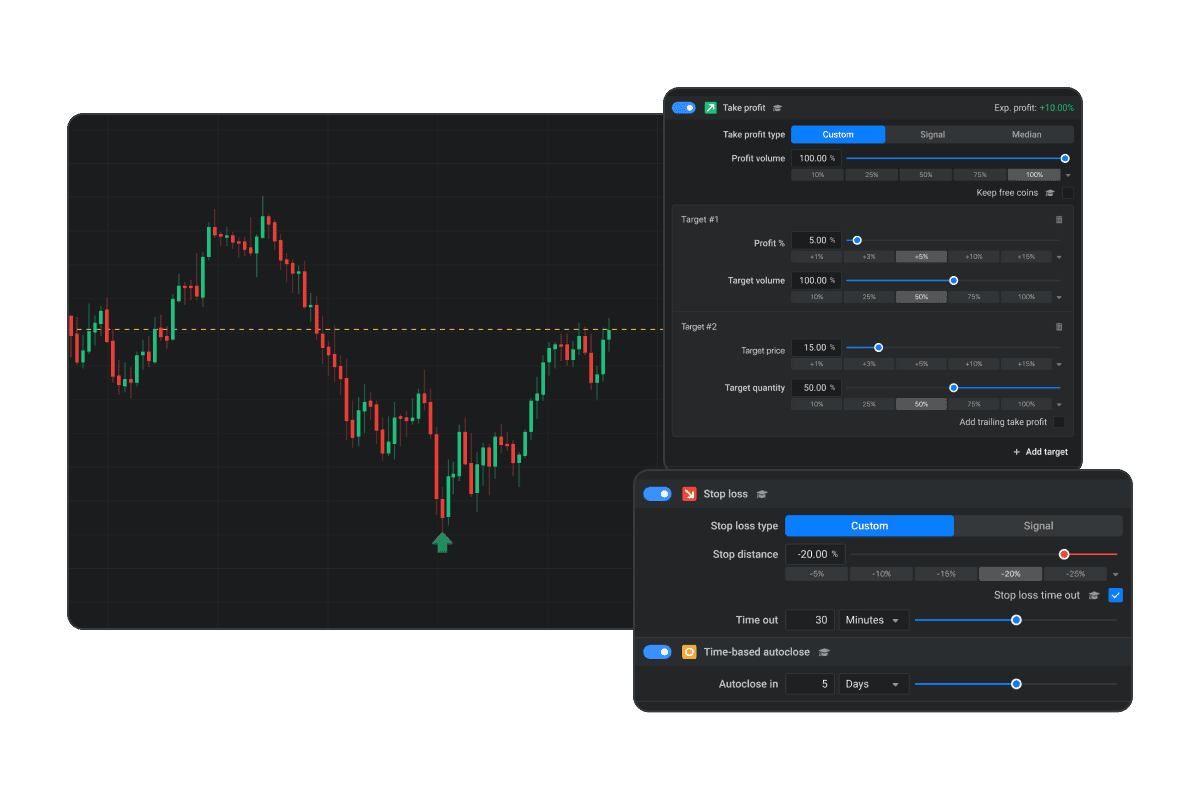

With our paper trading feature, you can access real-time market data and place orders like in a live account. You'll see how your trades would have performed if executed in real-time and make adjustments to your strategies.

The best part is you can do all this without any risk of losing real money. Experience the market without the risk and try our paper trading feature now.

GAIN EXPERIENCE

Gain Valuable Experience and Improve Your Skills

Paper trading offers many benefits to traders of all levels. It allows you to gain practical experience, enhance your skills and develop your trading strategies in a safe, risk-free environment.

You'll also have the opportunity to become more familiar with the Altrady trading platform, allowing you to navigate and execute trades more efficiently.

30% Off With Our Annual Plan

You can see a complete comparison on our Pricing page.

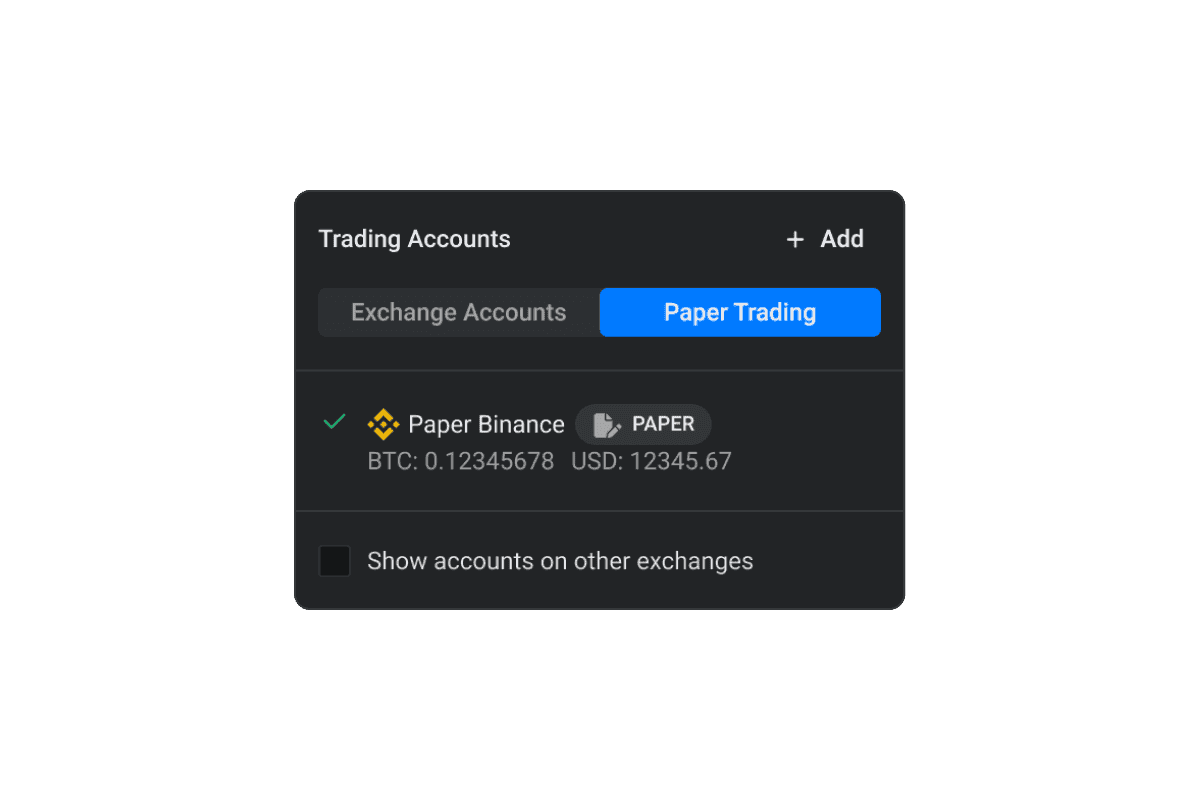

Paper Trading

Explore all Altrady features available with Paper Trading Account.

Upgrade once you ready to use Altrady with real account.

Test your strategy risk-free.

Basic

2 Bots (Signal or Grid Bot)

DCA Bots - unlimited

Futures Bots

Smart Orders

Backtesting

Premium

Essential Plan +

25 Bots(Signal or GRID bots)

500 Price Alerts

Quick Scanner(50 rules, 0.1% price change)

Data Export(CSV)

FAQ

What is crypto paper trading?

Crypto paper trading is a simulation of actual cryptocurrency trading that allows individuals to practice buying and selling digital currencies without risking real money. It mimics the real market conditions, enabling users to gain experience and test strategies.

Why is risk management important in crypto paper trading?

Risk management is crucial in crypto paper trading because it teaches traders how to protect their virtual capital from significant losses, which translates into better preparedness for managing real funds in the volatile crypto market.

Can crypto paper trading accurately reflect the experience of real cryptocurrency trading?

While crypto paper trading can simulate market conditions and pricing, it cannot fully replicate the emotional and psychological aspects of dealing with actual financial loss or gain, which can significantly influence decision-making in live trading.

How does one get started with crypto paper trading?

To start with crypto paper trading, you need to sign up for a platform that offers this feature. Many exchanges and apps provide simulated trading environments where you receive an amount of virtual currency to begin practicing your trades without financial risk.

Can successful paper trading strategies always be applied successfully to real-world cryptocurrency investing?

Success in paper trading does not guarantee success in live markets due to differences such as slippage, liquidity issues, trader psychology under real-world conditions, and potential overconfidence without actual monetary consequences. However, its a valuable learning tool for refining strategies before applying them with real money.