Risk Reward Calculator

Optimize your risk management strategies and trade with confidence.

Calculate the risk you are taking with the current position.

It also adjusts the investment size if you update the risk %

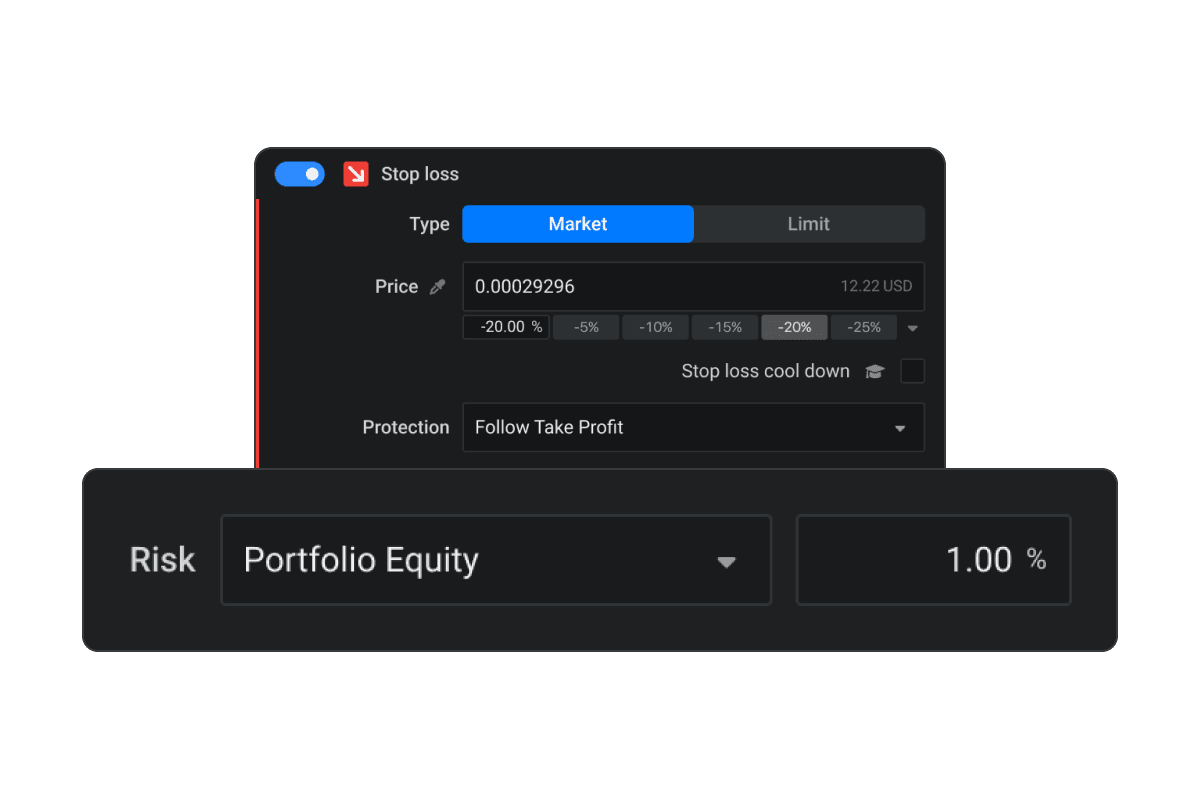

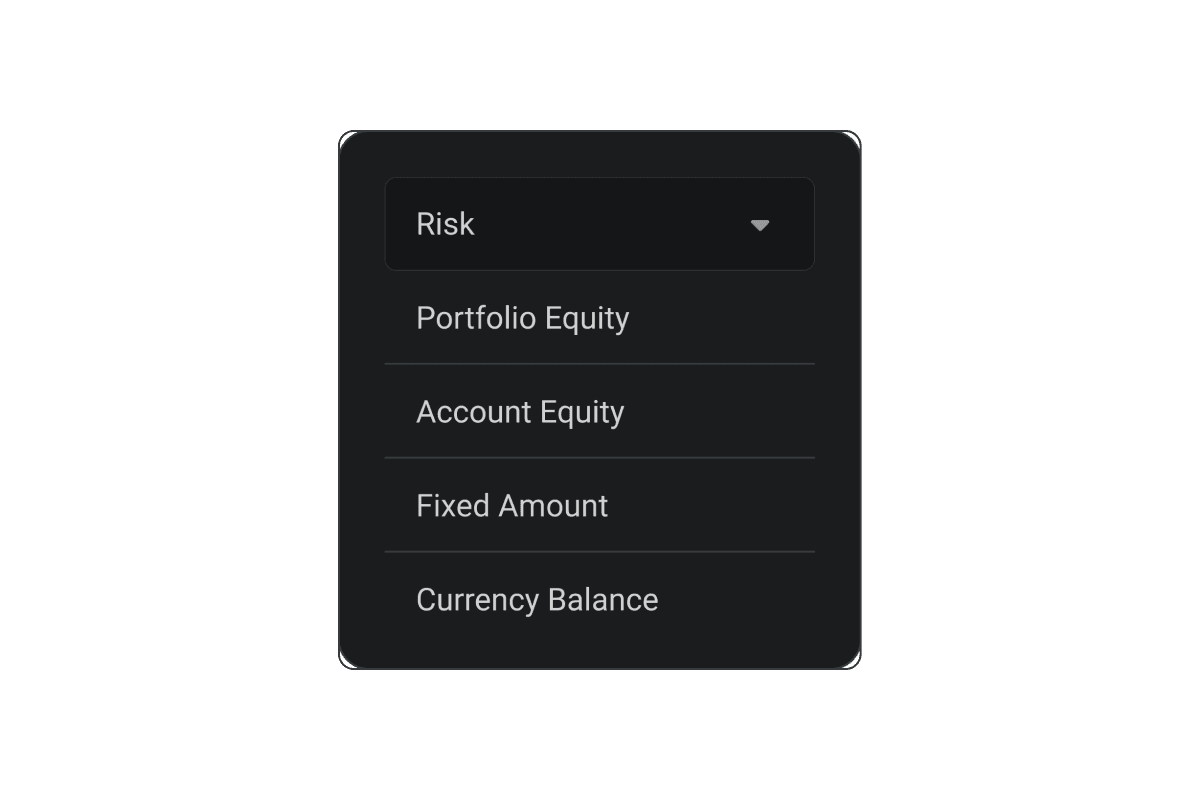

PORTFOLIO EQUITY

Portfolio Equity Calculates the risk based on your total portfolio size.

Portfolio Equity is a crucial metric for any investor looking to manage their risk exposure in the financial markets. It calculates the amount of risk in your portfolio based on your total investment size.

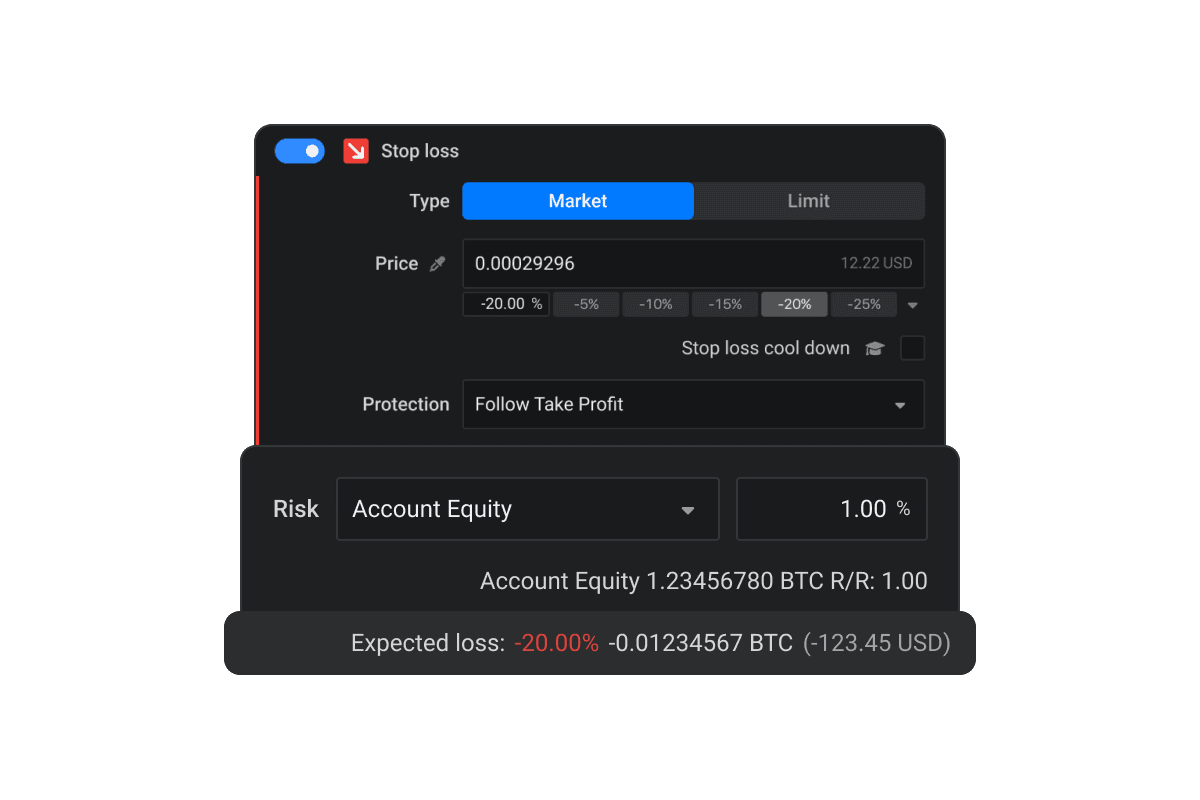

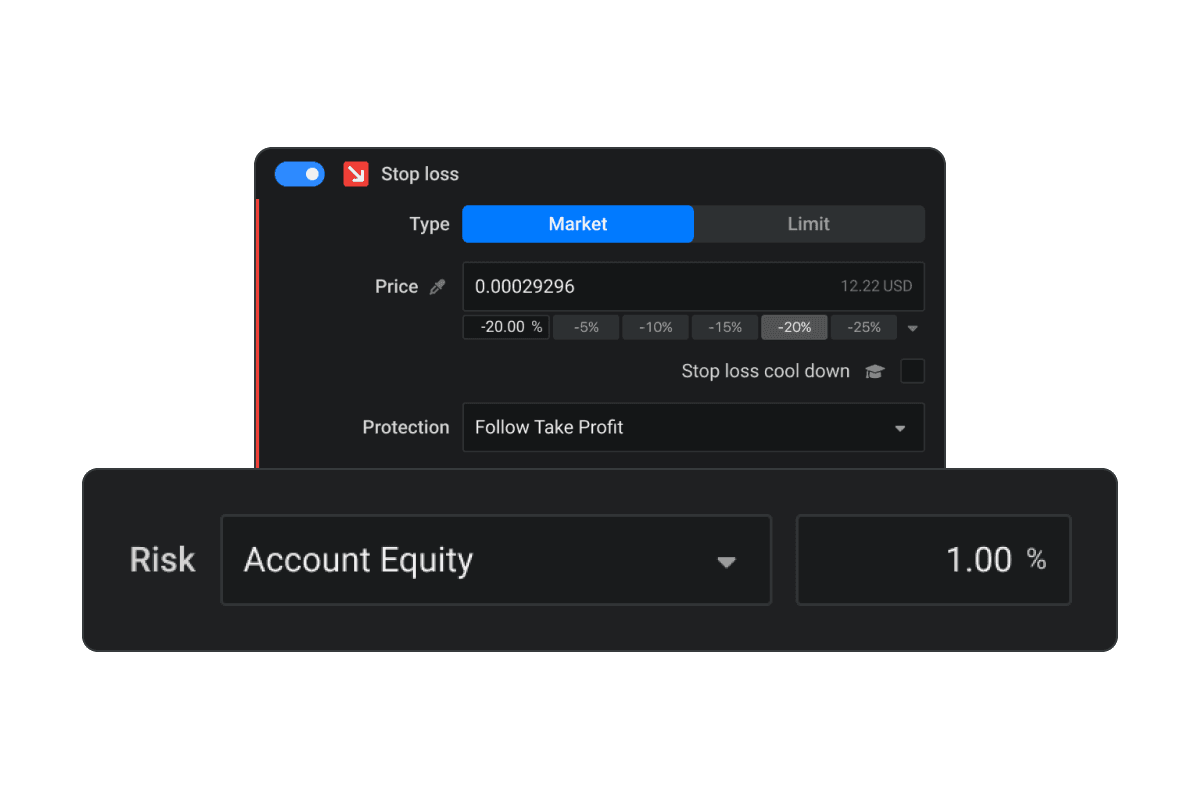

ACCOUNT EQUITY

Calculate the risk based on the size of your exchange account.

Account Equity is a fundamental metric for traders in the cryptocurrency market. It calculates the level of risk exposure on a specific exchange based on the trader's account balance size.

With Account Equity, you can manage risk effectively and make informed trade decisions on a specific exchange.

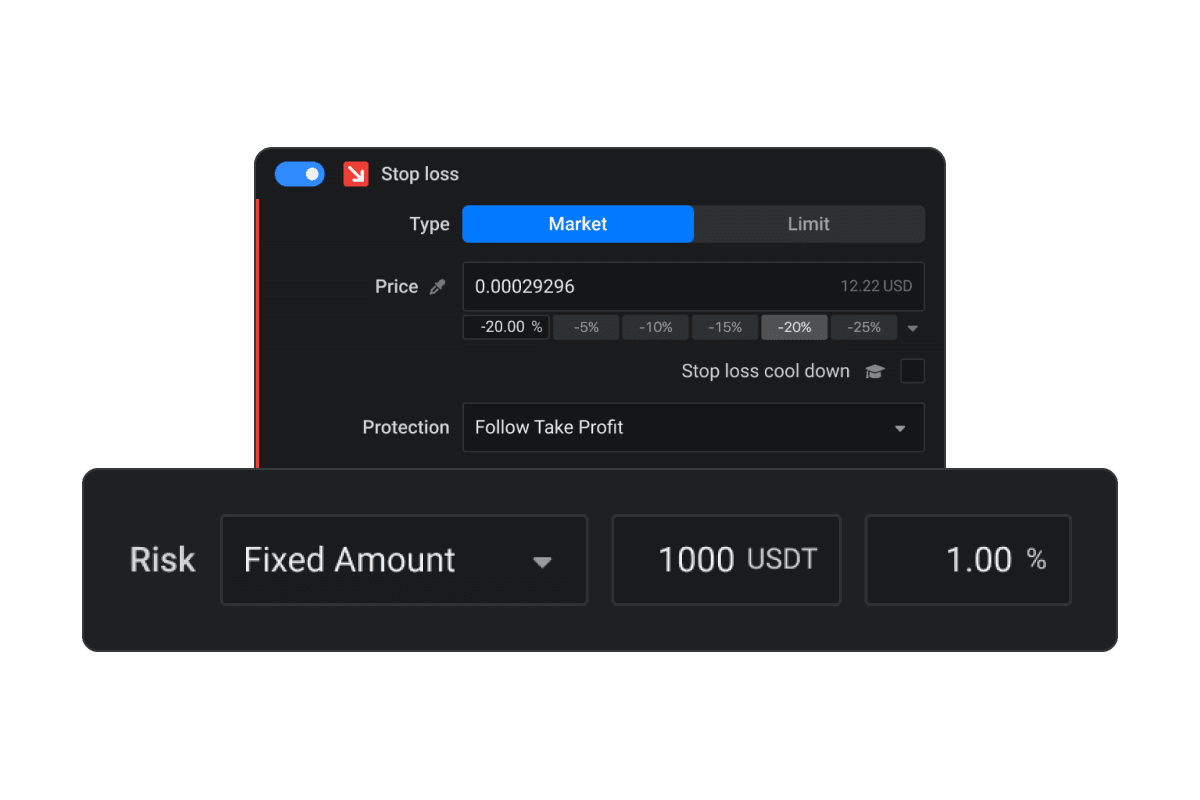

FIXED AMOUNT

Fixed amounts calculate the risk based on a specified amount.

It calculates the level of risk based on a specified amount, which can be used to limit the amount of capital at risk in a particular trade. By using Fixed Amounts, you can effectively manage the risk and protect your capital while taking advantage of potential opportunities in the market.

CURRENCY BALANCE

Currency Balance calculates the risk based on the balance of currency

Using Currency Balance, traders can effectively manage their risk and make informed decisions about their trades, considering the value of each currency in their portfolio.

30% Off With Our Annual Plan

You can see a complete comparison on our Pricing page.

Paper Trading

Explore all Altrady features available with Paper Trading Account.

Upgrade once you ready to use Altrady with real account.

Test your strategy risk-free.

Basic

2 Bots (Signal or Grid Bot)

DCA Bots - unlimited

Futures Bots

Smart Orders

Backtesting

Premium

Essential Plan +

25 Bots(Signal or GRID bots)

500 Price Alerts

Quick Scanner(50 rules, 0.1% price change)

Data Export(CSV)

FAQ

What is a risk-reward ratio calculator?

A risk-reward ratio calculator is a tool used by traders to assess the potential reward of a trade relative to its risk, helping them make informed decisions about whether the trade is worth taking. It calculates the ratio between the amount of capital at risk and the potential profit.

Why is understanding the risk-reward ratio important in trading?

Understanding the risk-reward ratio helps traders manage their capital effectively by avoiding trades with poor potential returns compared to risks. It ensures that traders aim for positions where possible gains justify taken risks, potentially leading to long-term profitability.

Can a trade with a low-risk reward ratio still be profitable?

Yes, a trade with a low-risk reward ratio can still be profitable if it has a high probability of success. However, consistently making trades with low ratios may require more winning trades to compensate for losses, increasing overall trading risks.

What is an ideal risk-reward ratio for cryptocurrency trading?

An ideal risk-reward ratio varies among traders based on their strategies and risk tolerance. However, many traders aim for a minimum of 1:2 or 1:3, meaning they seek at least two or three times more potential profit than they risk on any single trade.