Empowering Elite Traders with Next-Level Tools and Features

We offer professional trading solutions for the most advanced traders.

Do You Need More Trading Power?

Then Altrady can help, and here is how

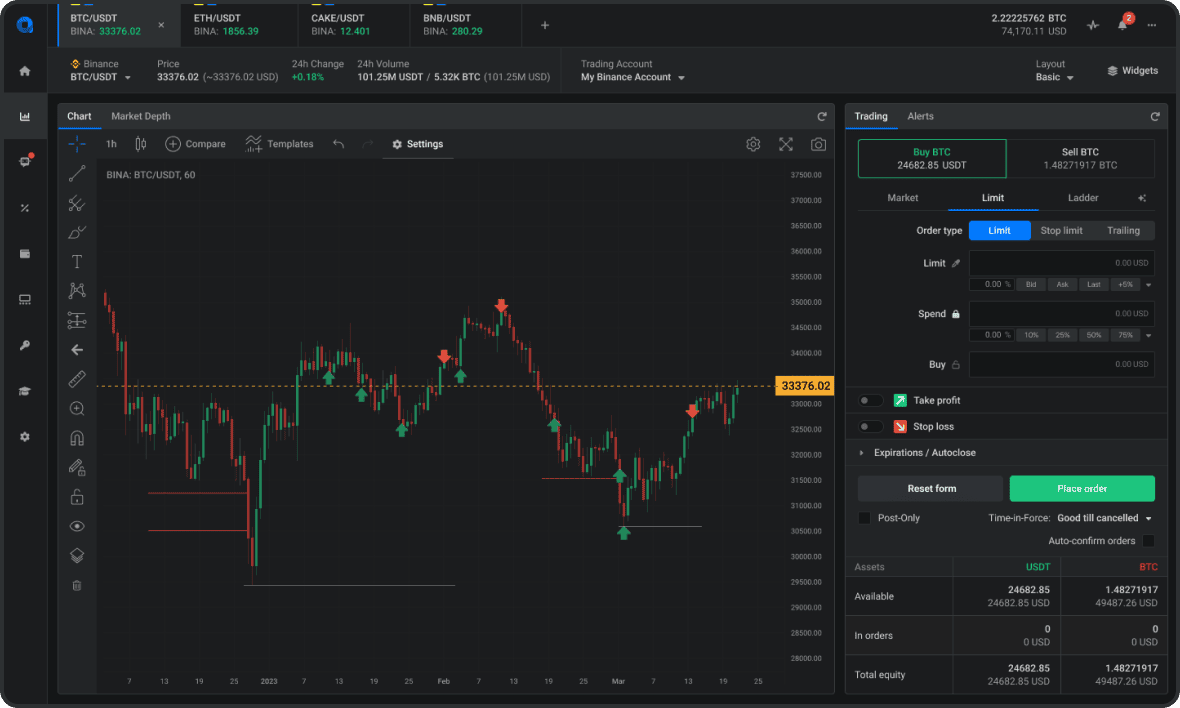

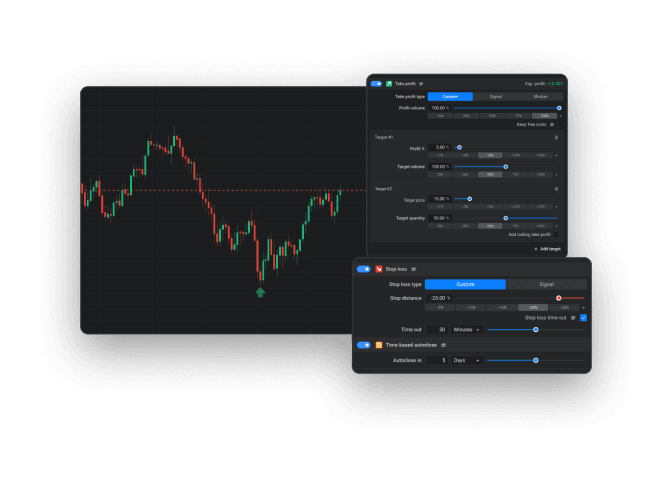

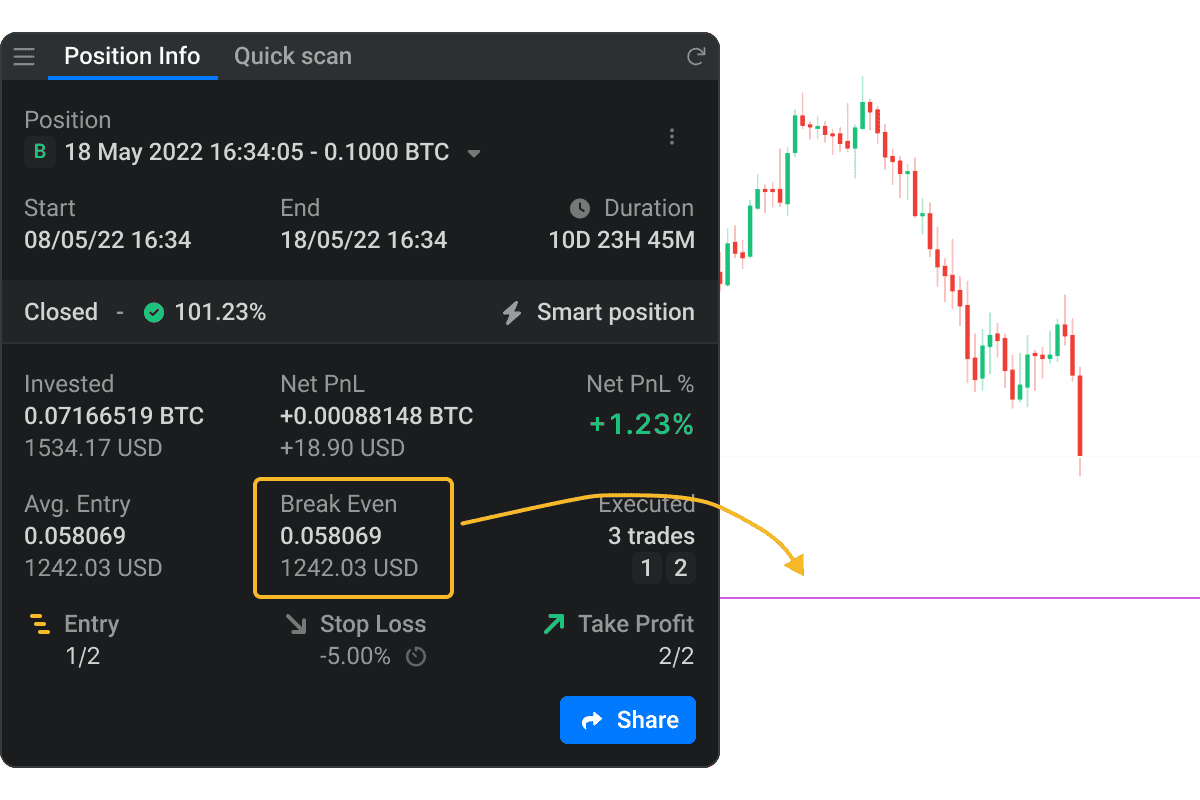

Advanced Smart Trading

Set up your entry and exit settings and let the system take over. Use Stop Loss, Take Profit, Trailing, Ladder & OCO orders. Also, you can use Trailing Take Profit or Trailing Stop Loss.

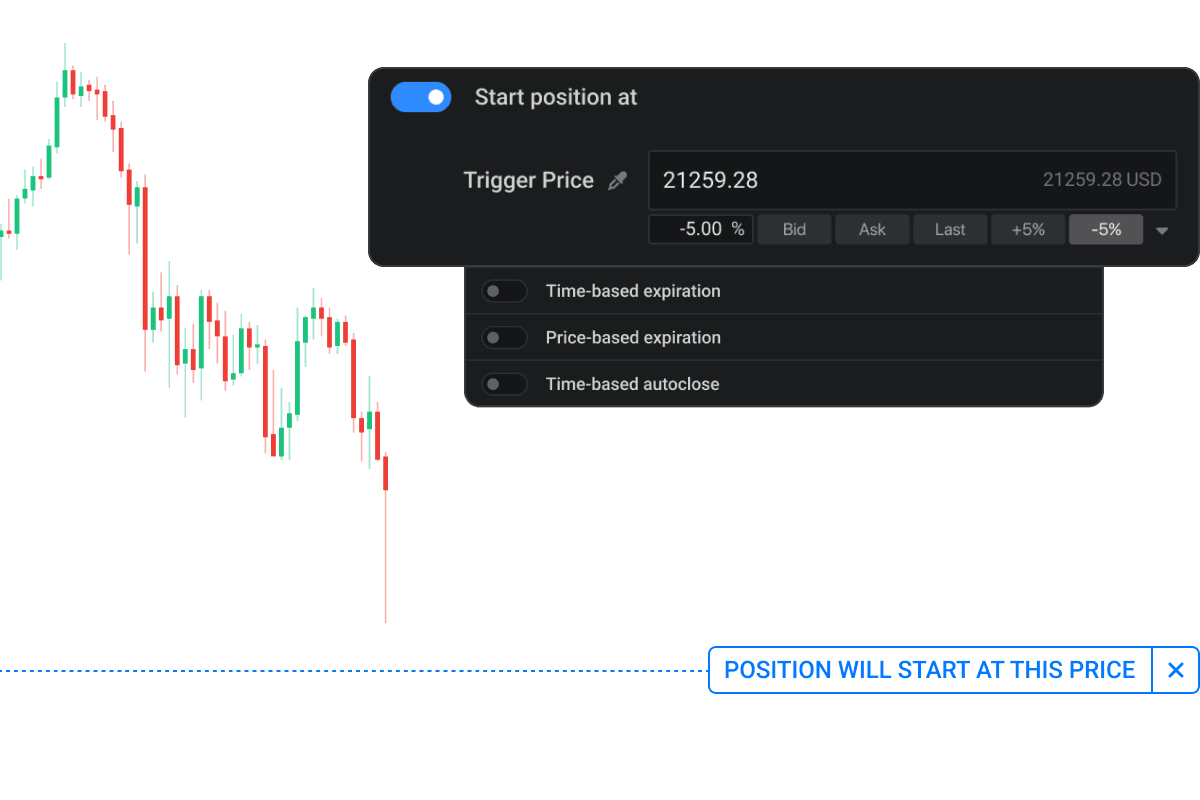

Conditional Orders

Conditional orders enable traders to execute orders automatically based on specific price conditions set by them. By setting up these orders, traders can plan their trades ahead of time and manage them automatically once the predetermined price condition is met.

One of the significant benefits of using conditional orders is that you can set up multiple positions without having to lock up your funds on the exchange. This allows you to maintain flexibility in your trading strategy while minimizing risk exposure.

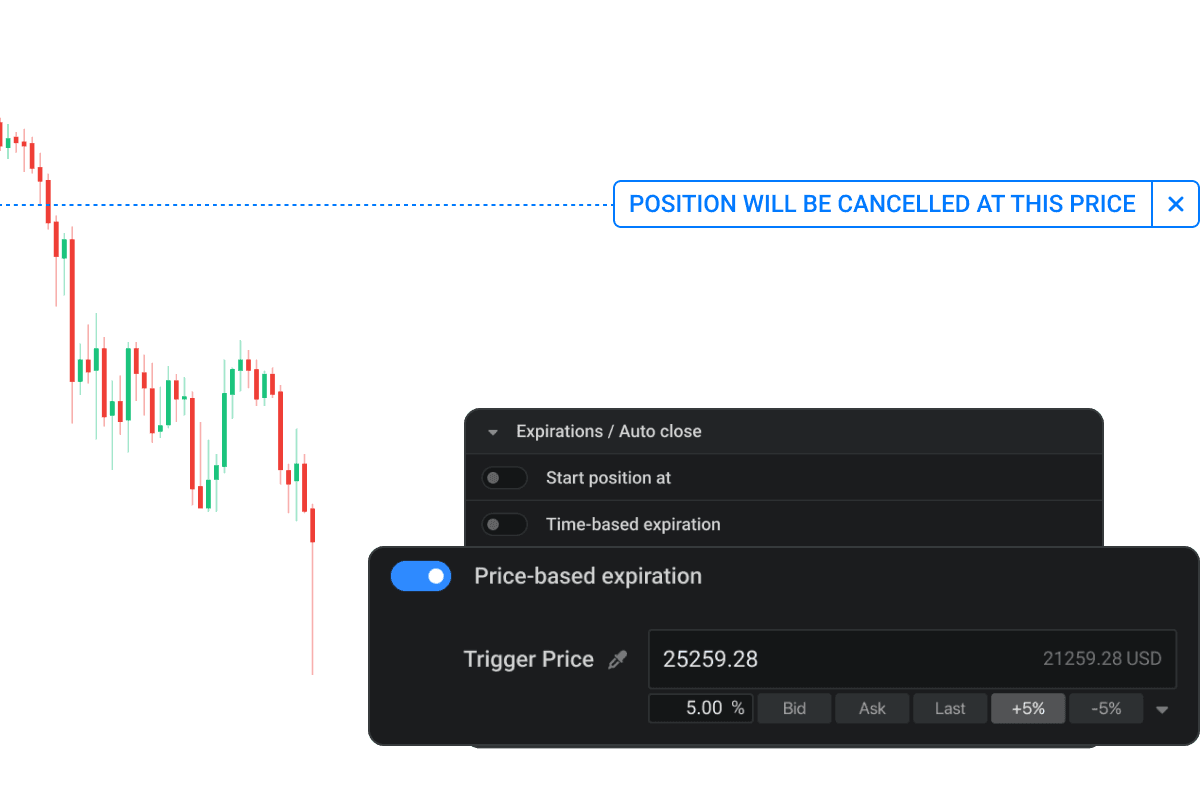

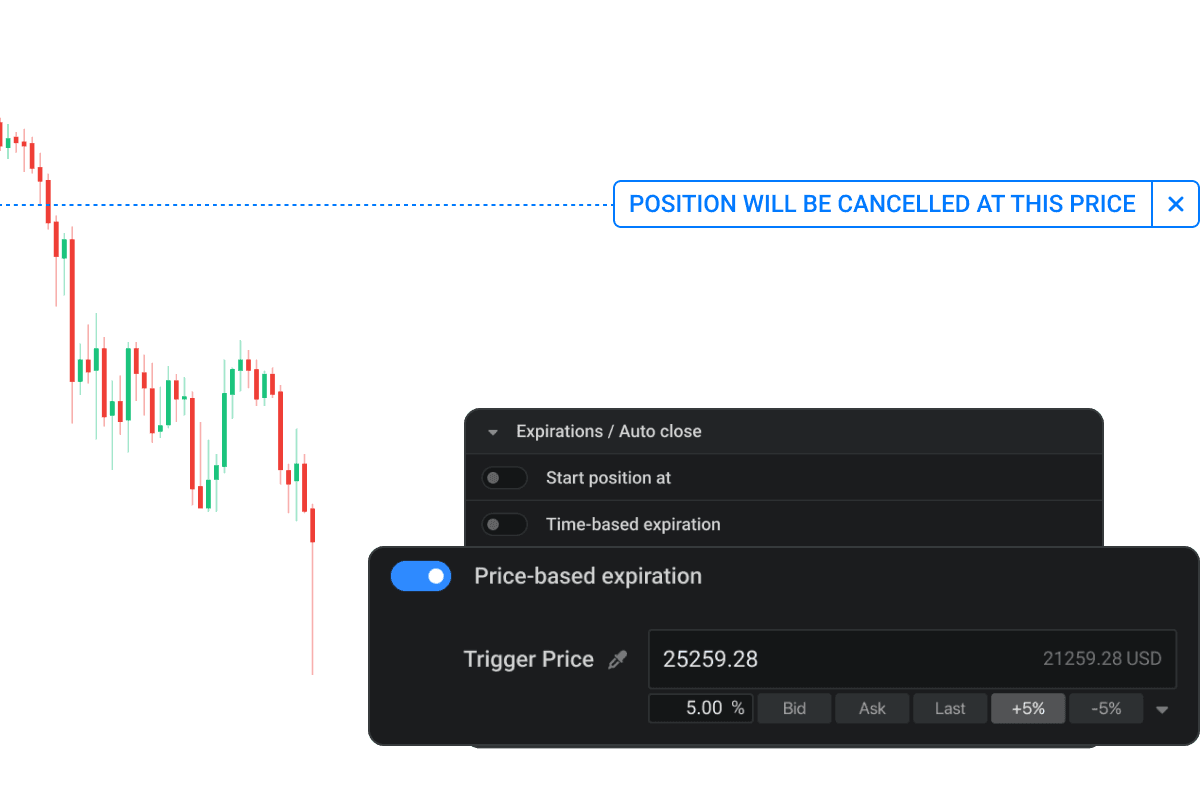

Price Based Expiration

The Price based expiration feature can only be utilized when creating an Entry Order in trading. Its primary function is to automatically cancel the Entry Order along with the position after a specified price has been reached.

This feature can be particularly beneficial when trading a market that moves in the opposite direction of your entries, thereby invalidating the reason for taking the position.

Time-based expiration / Entry Order Expiration

Time-based expiration can only be added when creating an Entry Order.Its purpose is to automatically cancel your Entry Order (and position) after a specified period of time has elapsed.The time is calculated from when you submit your Entry Order

Webook & Trading View

Altrady's webhook provides a convenient way to send signals from external sources such as Trading View or your own code and use them to create or close positions on Altrady's Signal Bot.

Futures Trading

Bot trading is available for futures trading on Binance, ByBit, and KuCoin exchanges. With bots, you can automate trading strategies and execute trades based on preset rules and conditions.

A signal bot can receive signals from an unlimited number of markets--for the same quote currency and exchange.

Support 24/7

We are committed to providing exceptional customer service to our users. That's why we offer free support 24/7, so you can get help whenever needed.

Our knowledgeable support team is available around the clock to answer your questions, resolve any issues you may encounter, and provide guidance on how to get the most out of our platform. Whether you're a beginner trader or an experienced professional, our team is here to support you every step of the way.

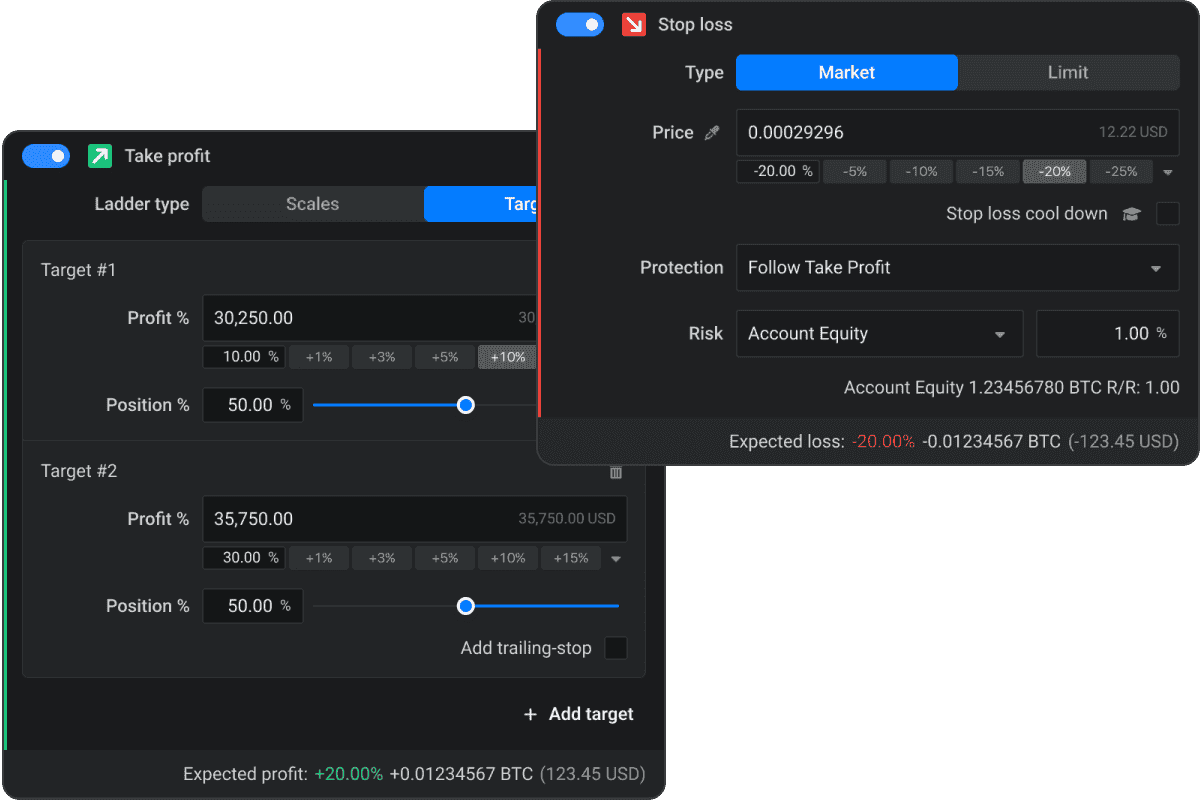

Risk Management Inside Altrady

We've developed our proprietary Risk Calculator to help you make informed trading

decisions and manage your emotions effectively.

Our Risk Calculator considers various factors to provide you with an accurate

estimate of potential profit and loss for each trade.

This valuable information lets you make more rational

and disciplined trading decisions and avoid emotional pitfalls like fear and greed.

Whether you're a seasoned trader or just starting, our Risk Calculator

is essential for managing your emotions and achieving long-term trading success.

Start Trading With Altrady Today

With our platform's unique tools,

Altrady has empowered over 70,000 traders!

Manage and grow your cryptocurrency portfolio.

Make Extra Money

By Sharing Your Learnings With The World

Sharing knowledge is key to fostering a strong and supportive trading community.

That's why we've developed our Affiliate Program, designed to reward

our users for sharing their learnings with the world.

With our Affiliate Program, you can earn extra money

by referring new users to our platform.

When someone signs up for Altrady using your unique referral link,

you'll receive a commission on their subscription fees.

Not only will you be making extra money, but you'll also be helping

others discover the benefits of Altrady's powerful trading tools and features.

Join us and make extra money.

By joining our program, you can earn a commission

for every sale through your unique referral link.

It's simple, easy, and a great way to monetize your online presence.

In The End, Your Life Will Be Better

In the end, your life will be better, and with Altrady by your side, your trading journey will be smoother than ever!

Live a balanced life

Achieve financial success while maintaining harmony in every aspect of your life with Altrady's comprehensive trading tools.

Improve your risk management

Take control of your investments and protect your assets like a pro with Altrady's advanced risk management features.

Have a sustainable asset growth plan and strategy

Build a solid foundation for long-term wealth creation with Altrady's innovative tools that help you develop sustainable asset growth plans and strategies.

Contribute to the growth of the community

Join a thriving community of traders, share insights, and contribute to the collective growth of the trading community with Altrady's collaborative platform.

Make objective trading decisions that are based on up-to-date and correct information

Stay ahead of the game with Altrady's real-time data and accurate market insights, enabling you to make informed and objective trading decisions.

Spend more time with your family and friends

Trade quickly and efficiently using Altrady's time-saving features, giving you more time to enjoy yourself with your loved ones.

FAQ

What advanced tools can help experienced crypto traders manage greed?

Experienced crypto traders can use risk management tools like stop-loss orders, take-profit orders, and portfolio diversification software to control greed. These tools allow traders to set predefined levels of profit-taking and acceptable losses, reducing emotional decision-making.

How do futures contracts work in the cryptocurrency market?

Futures contracts in the cryptocurrency market are agreements to buy or sell a specific digital asset at a predetermined price on a future date. This allows traders to speculate on price movements or hedge their positions against potential volatility without actually holding the underlying asset.

What information is crucial for making informed trading decisions in the crypto space?

Critical information includes real-time market data, news related to regulatory changes, technological advancements, blockchain analytics, sentiment analysis from social media platforms, and economic indicators that could affect the cryptocurrency markets.

Are there any tools designed specifically for tracking and analyzing futures contracts within the crypto market?

Yes, there are several analytical platforms that provide features such as futures contract price charting, open interest analysis, funding rate calculations for perpetual contracts, liquidation data visualization, and comparison of contract terms across different exchanges.

Can advanced trading tools help mitigate risks associated with highly leveraged futures trading in crypto markets?

Absolutely. Advanced trading tools like automated risk management systems can limit exposure through dynamic leverage adjustment and margin call alerts. Additionally, backtesting platforms enable traders to simulate strategies using historical data before applying them with high leverage in live markets.