Category List

Best Crypto Trading Bots in the Market

As new systems and technologies arise, cryptocurrency trading does so with them. The industry has never been more exciting, especially with the dawn of automation and trading bots. For those traders who strive to gain higher returns with less effort when trading or seasoned professionals looking for better efficiency when managing large holdings, understanding the diverse trading bots available can be a game-changer. Different strategies fulfill different trader needs, and recognizing which bot fits one approach or another can significantly impact trading success. This article delves into the most popular trading bots in the market.

Bot Trading As a Sophisticated Solution to Navigate the Crypto Market

In modern times, the bot trading approach has been dominating the path to master crypto trading from an automated standpoint. Traders come in masses towards specialized crypto trading platforms seeking to maximize profits with minimal effort.

Bot trading fulfills their greed by enabling them to enter the market while harnessing algorithms that perform diverse strategies and harvest high-standard outcomes. This method represents an unparalleled technique to execute orders at high speed if required, but also to manage long-term portfolios that demand asset reallocation and rebalancing over time.

Either way, bots fuel the ambition of traders to navigate the market with confidence. Although these systems are not infallible, their allure conquers new traders every day given their benefits that we can point out in the following list:

- Reduce the impact of emotions in making trading decisions.

- Help traders achieve consistency.

- Minimize the time spent analyzing charts. However, traders may still invest time in deeper market research.

- Execute several trades at high speed. This is ideal for scalping strategies.

Bots' capabilities have drowned the market with countless offerings. One question that arises is: what are the best crypto trading bots? Let's solve that issue by starting to describe each available one.

Trading Bots Powered by AI

Artificial intelligence has captivated multiple industries, and the cryptocurrency one is not an exemption. AI relies on machine learning and neural networks that provide these systems with self-improvement capabilities.

AI Trading Bots present traders with a unique procedure to adapt to changing market conditions rapidly, as asset prices take certain directions. This ability leans on historical data that traders research for the bots to learn from as they perform in the market.

In essence, trading bots powered by AI adapt automatically to new market sentiments at astonishing speed, aiming to not miss on the volatility and consolidating firmly to a determined strategy,

It is crucial to remark that while these bots are data-driven systems, they may suffer from over-lifting historical market patterns, making them unable to adapt to new conditions. They need to be accurately monitored and prepared by human traders.

DCA Bots: Accumulate and Average Investments

Dollar-cost averaging (DCA) bots are ideal for traders looking to capture market potential over time without being overwhelmed by the volatility typical of crypto markets.

By making regular purchases at predetermined intervals, DCA bots help traders avoid the pitfall of trying to time the market. This strategy can be applied to both spot and futures trading.

For example, a DCA bot set up to invest a fixed amount weekly into Bitcoin or Ethereum will buy more when prices are low and less when they are high, averaging the overall investment cost.

This is highly beneficial for new traders who might feel stressed about making substantial trades during market volatility.

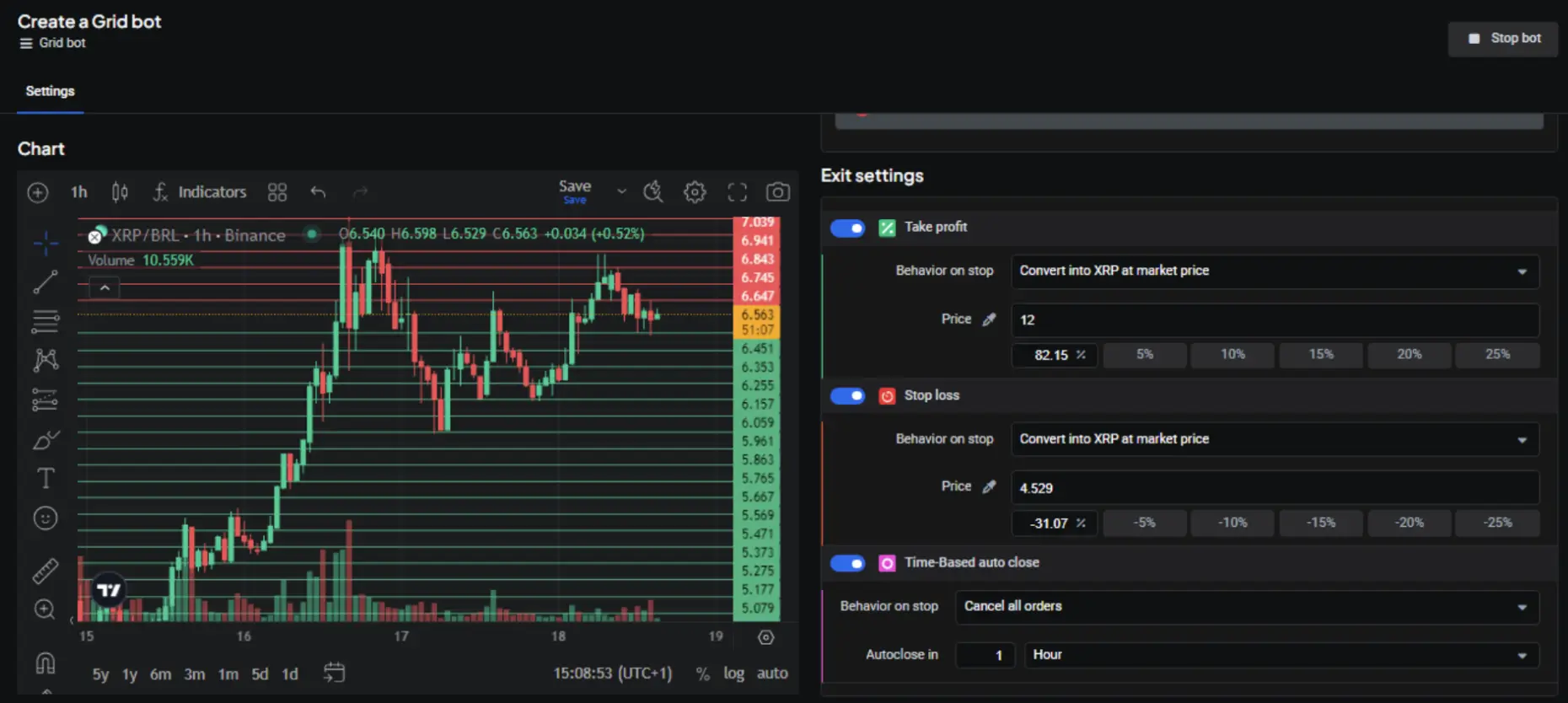

Grid Bots: Capitalizing on Sideways Fluctuations

For those traders who thrive on capitalizing from market sideways fluctuations, grid bots might spark their interest. These bots create a grid of buy and sell orders around a set price, allowing traders to profit from price movements in both directions.

Whether for trading spot markets or futures contracts, grid bots can automate the process of placing multiple orders at regular intervals, aiming to capitalize on every small price move.

This approach can be particularly advantageous in sideways-moving (ranges) markets, where consistent small profits can accumulate over time.

Arbitrage Bots: Seizing Price Discrepancies

For those seeking a more sophisticated trading strategy, arbitrage bots can be an attractive option. These bots identify price discrepancies across different exchanges and execute trades to exploit these disparities.

For example, if Bitcoin is trading at a lower price on one exchange in contrast to another, an arbitrage bot buys from the cheaper exchange and sells on the more expensive one, locking in profit instantly.

This bot type sometimes requires more technical knowledge and speed, making it more suitable for experienced traders who can move quickly in a fast-paced market.

The Offer of Altrady

Signal Bot with Webhook and TradingView Support

The Signal Bot of Altrady leverages algorithms and market scanners to provide buy and sell signals, notifying traders when to make their moves. With webhook and TradingView support, these bots can receive custom signals and act upon alerts in real time, allowing for quick decision-making.

The integration with TradingView makes it simple for traders to set up their technical analysis while running pine script strategies to get automated signals that will open positions without constant monitoring.

This bot can also work with DCA strategies since this level of automation can be beneficial for traders who cannot dedicate significant time to market analysis but still want to maintain a hands-on approach.

Scalping Bot: A High-Frequency Solution Based on Market Scanner

For those who thrive on quick wins, scalping bots are the way to go. Altrady offers a quick scanner for identifying quick rising and dropping markets.

On the other hand, the QFL Smart Bot is powered by the Signal Bot and Base scanners.

These bots are designed to execute trades autonomously that can serve scalpers and day traders who implement short-term strategies.

Conclusion

The market has various bots to offer and choosing the right one can be a vital component of a crypto trader's strategy. Embracing automation not only enhances efficiency but can also lead to more consistent results, allowing traders to capitalize on different market scenarios and gain steady profits. Platforms like Altrady offer bot solutions that cater to both novice and advanced traders, helping them to navigate the complexities of the crypto market with ease.

Altrady is a crypto trading platform with multi-exchange integration features where beginners and professional investors manage assets across multiple accounts simultaneously, seizing algorithmic, automation, and bot functionalities. Sign up for a free trial account today.