Category List

How to use Crypto Trading Tools to improve your trading

Whether you're a seasoned trader or a complete newcomer, one question likely looms in your mind: Is crypto trading profitable? The answer to that often depends on your understanding of the market and the tools at your disposal. In this blog post, we're going to delve into two crucial elements that can significantly impact your trading journey crypto trading tools and choosing the right crypto trading platform.

Understanding how to effectively utilize crypto trading tools can be the difference between a profitable trade and a losing one. From real-time charting software to trading bots that execute trades while you sleep, these tools are designed to give you an edge in the market. Additionally, your choice of a crypto trading platform can greatly influence your trading experience. A good platform not only provides a user-friendly interface and robust security measures but also offers a variety of trading options to suit your needs.

What are Crypto Trading Tools?

Crypto Trading Tools are specialized software or platforms designed to assist traders in making informed decisions in the cryptocurrency market. Like traditional financial markets have tools like stock screeners, technical indicators, and portfolio managers, the crypto universe is no different. It comes equipped with various tools that help you analyze price trends, execute trades automatically, and manage your investment portfolio, among other functionalities.

For instance, charting software provides real-time price graphs and technical indicators that allow traders to forecast future price movements based on historical data. On the other hand, trading bots use signals to execute trades on your behalf based on a pre-set criteria. There are also portfolio trackers that help you keep track of your assets across multiple exchanges, wallets, and even cold storage solutions.

The primary goal of using crypto trading tools like Altrady, is to make your trading experience more efficient, informed, and potentially, more profitable. These tools can save you time, reduce the emotional factors that often lead to impulsive decisions, and provide insights that you may not have considered otherwise.

Categories of Crypto Trading Tools

As the cryptocurrency trading ecosystem becomes more complex, a plethora of tools have emerged to serve different trading strategies and needs. Broadly, these tools can be categorized into three main types: technical analysis tools, fundamental analysis tools, and sentiment analysis tools.

Technical Analysis Tools

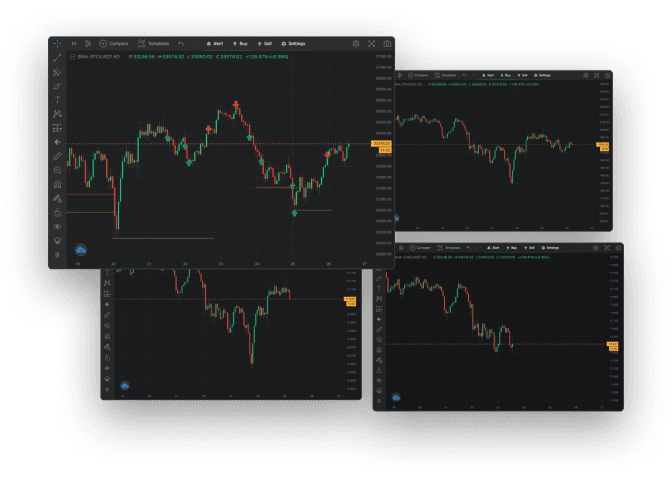

These are perhaps the most commonly used crypto trading tools and are essential for anyone looking to trade based on price action. The technical analysis tools offer features like real-time charting, numerous technical indicators (e.g., Moving Averages, RSI, MACD), and sometimes even algorithmic trading options. Tools like TradingView are popular in this category, providing novice and experienced traders with a wealth of options to analyze and predict price movements. Altrady includes TradingView, so you don't need to leave your terminal to analyze the markets.

Fundamental Analysis Tools

If you're the type who likes to dive deep into the financials and future prospects of a cryptocurrency or token, then fundamental analysis tools are for you. These tools provide data on metrics like market capitalization, trading volume, and token utility. They also offer news aggregators and community sentiment indicators that can help you gauge the market's perception of a particular asset. The Altrady Market Explorer provides you with all the coin information relevant for trading.

![[Features] - Market Explore - Best and Worst.png](/_next/image?url=https%3A%2F%2Faltrady-strapi.s3.eu-west-1.amazonaws.com%2FFeatures_Market_Explore_Best_and_Worst_56251c386f.png&w=3840&q=75)

Sentiment Analysis Tools

Understanding market sentiment is often considered the X-factor in crypto trading. Sentiment analysis tools help you gauge the mood of the market by analyzing social media posts, news articles, and sometimes even trading patterns. For this reason Altrady includes a news feed for each coin your are trading. If you see a big movement in the price, you can quickly check the news feed to see if it's based on some event.

In summary, each category of crypto trading tools serves a unique purpose and can be immensely useful depending on your trading style and strategies. It's often beneficial to use a combination of these tools to form a well-rounded trading approach. The good news is that many crypto trading platforms offer a range of these tools built right into their systems, making it convenient for traders to make informed decisions.

How to choose the right Crypto Trading Tools?

Selecting the appropriate tool for your cryptocurrency trading can be as crucial as choosing the right tools. A reliable and user-friendly crypto trading platform can greatly enhance your ability to trade effectively, securely, and profitably. Let's delve into the key features you should consider and some of the popular options available.

Features to Consider

When choosing a crypto trading platform, several key features can significantly impact your trading experience. Here are some to keep in mind:

Security

Security should be your top priority. Always opt for platforms that employ robust security measures, including two-factor authentication (2FA), cold storage solutions for funds, and end-to-end encryption. Altrady uses a state-of-the-art encryption method that is unique among all the crypto trading platforms. With a randomly generated password, your API keys are encrypted to the highest standard and can only be used on devices that you've authorized.

User Interface

The platform's user interface should be intuitive and user-friendly. This will allow you to find features and execute trades efficiently, especially if you're new to crypto trading. The user interface in Alltrady is highly customizable and allows you to configure the best experience to fit your style of trading.

Supported Exchanges

You should look for the crypto trading platforms that offer the widest range of exchanges for trading. This allows you to spread your funds across exchanges and you reduce the risk of loosing your entire portfolio in case something happens to an exchange. With over 17 exchanges, Altrady has got you covered!

Which Tool is Best for Crypto Trading?

One of the most frequently asked questions by aspiring traders is, "Which tool is best for crypto trading?" The answer isn't straightforward, as it often depends on individual preferences, trading style, and specific needs. However, there are some general guidelines and popular options that can help you make an informed decision.

Desktop vs. Mobile Tools

Before we dive into specific software options, let's discuss the medium through which you access these tools: desktop or mobile.

Desktop Tool

- Pros: More features, easier to conduct in-depth analysis, usually more robust and stable.

- Cons: Not as portable, often require a powerful computer for best performance.

Mobile Apps

- Pros: Portability, convenience for quick trades and checking your portfolio on the go.

- Cons: Usually fewer features, smaller screen can make analysis challenging.

Both have their merits, and you might find it beneficial to use a combination of both for different purposes.

Comparing Top Tools Options

Given the plethora of options available, choosing the right tool can be daunting. Here are some top contenders in the space:

Altrady

- Features: Known for its advanced trading terminal, trailing stop losses, take profits, risk-reward calculation, position tracker, portfolio management, and many more features.

- Best For: Traders interested in automated and semi-automated trading for day and long-term traders.

TradingView

- Features: Offers advanced charting tools, social networking for traders, and a wide range of technical indicators.

- Best For: Traders who rely heavily on technical analysis.

3Commas

- Features: Known for its trading bots that allow for automated trading based on custom strategies, trailing stop losses, and portfolio rebalancing.

- Best For: Traders interested in automated trading signals and portfolio management.

Each of these platforms has its pros and cons, and the best choice will depend on your specific needs, level of expertise, and trading strategy. Some may excel in technical analysis features while others might focus on ease of use or automation capabilities.

By carefully considering what you need in a trading software, you can make a choice that enhances your ability to trade profitably. With Altrady you can try all the features for free during a 14 day trial or you can continue for free forever using a paper trading account.

Is Crypto Trading Profitable?

The question of profitability is often the make-or-break factor for many aspiring traders. "Is crypto trading profitable?" is a question that doesn't have a one-size-fits-all answer. While there are countless success stories, there are also tales of losses and financial ruin. The volatility of cryptocurrency markets can be both an opportunity and a pitfall. Let's explore how you can tilt the scales in your favor.

Potential for Profit

Realistic Expectations

While stories of crypto millionaires may inspire dreams of quick riches, it's crucial to have realistic expectations. The volatility that can produce significant gains can also result in substantial losses.

Risks Involved

Understanding and managing risk is crucial in the crypto space. A thorough understanding of leverage, margin trading, and risk management strategies can be invaluable. Tools like stop-loss and take-profit orders can help you manage your risks better. Using the risk reward calculator in Altrady ensures that all your trades have equal risk.

![[Features] - Risk - Risk Based.png](/_next/image?url=https%3A%2F%2Faltrady-strapi.s3.eu-west-1.amazonaws.com%2FFeatures_Risk_Risk_Based_d58dee2158.png&w=3840&q=75)

How to enhance your profitability?

Role of Crypto Trading Tools

Utilizing the right crypto trading tools can significantly influence your success. As discussed earlier, these tools can provide real-time analysis, automate repetitive tasks, and offer insights into market sentiment, thus enabling more informed decisions.

Importance of Continuous Learning

The crypto market is continually evolving, and staying updated with the latest trends, news, and technologies is essential. Continuous learning can give you the insights to adapt your strategies to a changing market.

Diversification

Putting all your eggs in one basket is rarely a good idea in any form of investment. Diversifying your investments across different types of assets can help you mitigate risks. Here again, the right trading platform can make it easier to manage a diversified portfolio.

Manual take over

If you have experience with bot trading, you will have realized by now that some losses could have resulted in profit. Therefore it's sometimes important to be able to adjust the price levels of positions created by a trading bot. Positions created by the Altrady trading bots are easily adjusted in the trading terminal. This will result in better placing your take profit orders and ultimately reduce the number of losses.

![[Features] - Smart Trading - Take Profit.png](/_next/image?url=https%3A%2F%2Faltrady-strapi.s3.eu-west-1.amazonaws.com%2FFeatures_Smart_Trading_Take_Profit_97ef9e1264.png&w=3840&q=75)

In summary, while crypto trading can indeed be profitable, it comes with its share of risks and challenges. Utilizing the right set of crypto trading tools and platforms, continuous learning, and effective risk management are key elements that can contribute to your trading success.

Best Practices for Using Crypto Trading Tools Securely and Efficiently

You're armed with knowledge about crypto trading tools, the significance of choosing the right crypto trading platform, and insights into the profitability of crypto trading. Now let's focus on best practices to ensure you're using these tools securely and efficiently.

Security Best Practices

Two-Factor Authentication (2FA)

Always enable 2FA where available. This extra layer of security can help protect your account from unauthorized access.

Software Updates

Make sure that your trading software and platforms are up to date. Developers frequently release security patches, and staying updated ensures you're protected against known vulnerabilities.

Be Cautious of Phishing Attempts

Be vigilant about phishing attempts that may look like legitimate messages from your trading platform. Always double-check URLs and email senders.

Use Secure Networks

Avoid using public Wi-Fi when trading or accessing your portfolio. Unsecured networks can expose you to unnecessary risks.

Efficiency Best Practices

Customize Alerts

Many crypto trading tools allow you to set custom alerts for price changes, volume spikes, or other critical market events. Use this feature to stay informed in real-time without having to constantly monitor charts.

Test Strategies with Paper Trading

Before applying a new strategy or using a new tool, consider using paper trading features to test its effectiveness without risking real money.

![[Features] - Paper Trading - Hero.png](/_next/image?url=https%3A%2F%2Faltrady-strapi.s3.eu-west-1.amazonaws.com%2FFeatures_Paper_Trading_Hero_3c379c0f7e.png&w=3840&q=75)

Backtest Your Strategies

If your trading tool allows, backtesting strategies against historical data can provide insights into their effectiveness.

Leverage Automated Tools Judiciously

Automated tools like trading bots can be incredibly efficient but use them judiciously. Too much automation can expose you to risks if you don't fully understand the strategy the bot is implementing. Use the Altrady terminal to verify your the trade setups by visually seeing the orders and trades on the chart.

Continuous Monitoring and Learning

The crypto market doesn't sleep, and while it's impossible for you to stay up 24/7, continuous monitoring can help you catch opportunities or avoid pitfalls. Make it a habit to review your strategies, learn from your successes and failures, and adapt your approach accordingly.

By following these best practices, you can maximize the advantages offered by crypto trading tools and platforms. The key to profitable trading is not just having the right tools but also using them effectively and securely.

In closing, while the world of crypto trading can be complex and filled with uncertainties, armed with the right tools and knowledge, you're well on your way to making more informed and potentially profitable decisions. Happy trading!

Benoist is the founder of Altrady. With a background in software engineering and over 12 years of experience in designing identity platforms used by several governments in the EU, he has a wealth of experience in both technology and security services.

FREE PAPER TRADING PLAN FOREVER

Practice trading with no risk and no time limit!

Altrady's free forever paper trading plan is the perfect way to sharpen your skills and boost your confidence.

After the 14 days free trial, you will have unlimited access to the Free Paper Trading Plan.