Category List

Featured List

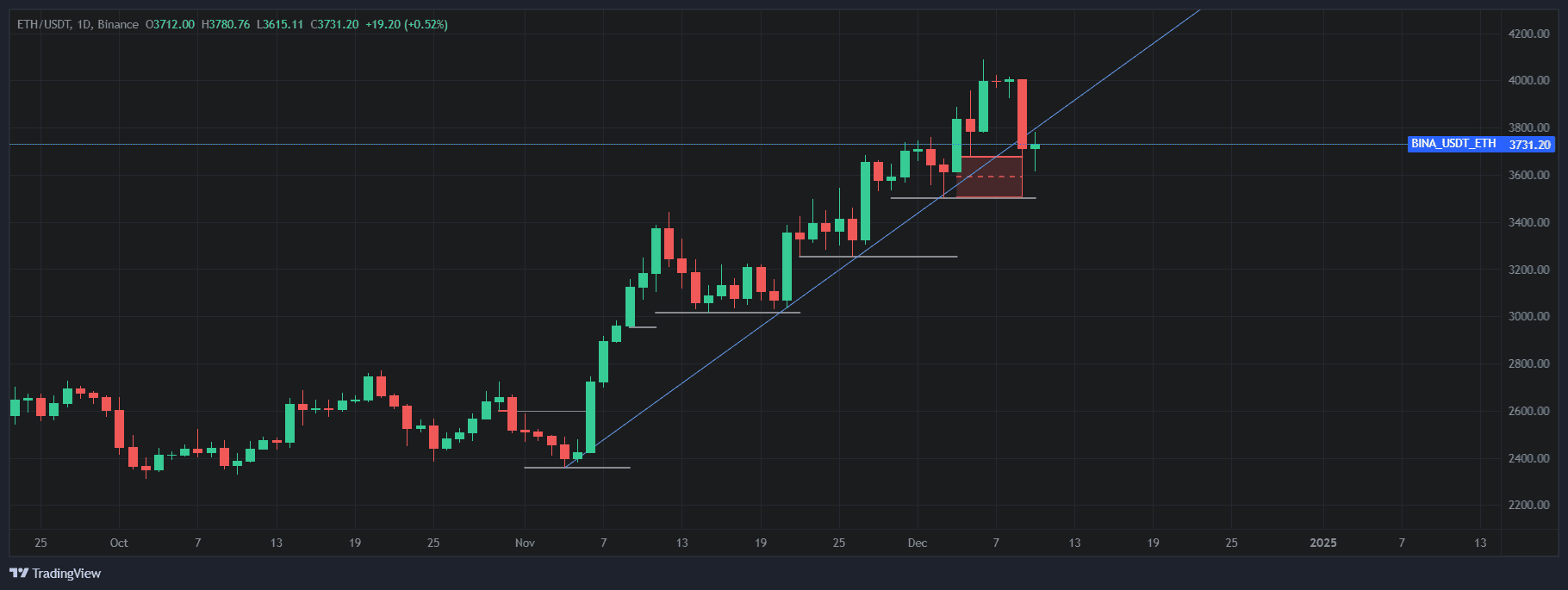

Ethereum Is at a Crossroads – Will It Be Able to Break 4K or Are We Close to a Reversal?

Ethereum's price is hovering in a critical zone near $3.7K, closing in on the key psychological barrier at $4K. While the market remains broadly bullish, the recent break of the support trendline, which had defined the bull run in recent weeks, introduces short-term uncertainty. Price fluctuations within the $ 3.7K-$4K range are likely before a decisive breakout or a deeper pullback.

Testing the $4K Resistance

Ethereum has made remarkable strides, approaching its yearly high at $4K—a level that represents a significant zone of selling pressure. Recent attempts to breach this resistance have met rejection, causing a slight decline and underscoring the challenge buyers face in overcoming this barrier.

Low Volatility Points to Consolidation

The market is entering a period of reduced volatility, signaling the potential for a consolidation phase. ETH may trade sideways within the $3.5K-$4K range as buyers and sellers reach a temporary equilibrium.

Despite the resistance, Ethereum’s strong fundamentals suggest that buyers may soon launch another push to break through the $4K mark. For now, the market appears to be pausing to digest recent gains.

Funding Rates Surge: A Bullish Signal with a Warning

Ethereum’s Funding Rates, a key indicator of futures market sentiment, have climbed to their highest levels since January 2024, but it is drastically collapsing in this month of December.

Source: Coinglass

The spike in funding rates also hints at the need for a short-term correction to sustain this bullish momentum. High funding rates often signal overheated markets, making a pullback necessary for healthier and more sustainable growth.

What’s Next for Ethereum?

Ethereum is at a crucial moment. While the $4,000 resistance poses a challenge, strong sentiment and market fundamentals have potential for new highs in the near future. A brief period of consolidation or correction is upon us, but if sentiment changes and investors begin to liquidate their positions, then Ethereum would face a major price reversal.

Stay tuned as we track Ethereum's progress in breaking past this critical resistance zone—will it achieve a new all-time high, or will the market take a breather first?