Category List

Featured List

Essential SMC Indicators for Effective Crypto Trading

Intro

Smart Money Concepts set the basis for analyzing the markets in a structured and advanced manner, leveling the bet up over price action without depending on technical tools.

Terms like "manipulation" or "institutional trading" are prevalent for this type of trading approach.

In this guide, we will explore the Smart Money indicators and their utility, advantages, and disadvantages

Brief Overview of Smart Money Trading

The market structure is the core idea outlining the setups for entries, risk management, and trading performance.

It is said typically that smart money traders go out to hunt the "dumb money" who are the novices and inexperienced traders known as "the weak hands".

Key Aspects of Smart Money

- Smart Money Relies on Market Structure.

- Intrinsically correlated to Price Action.

- Volume can be considered its only technical tool.

- Support and resistance, swing high and swing low shape the market structure.

- Manipulation alongside institutional trading is part of its main focus.

Smart Money Framework: Advanced Indicators For Analyzing Crypto Market

The framework provided by Smart Money Trading is a basic but structured and conceptualized approach. Let's point out the basic pillars:

- Market Context.

- Price Action.

- Supply and Demand Zones.

- Market Structure.

- Timeframes.

Understanding these pillars will lead us to the advanced application of smart money concepts. But how? Well, we could classify them into the most relevant:

Chart footprints

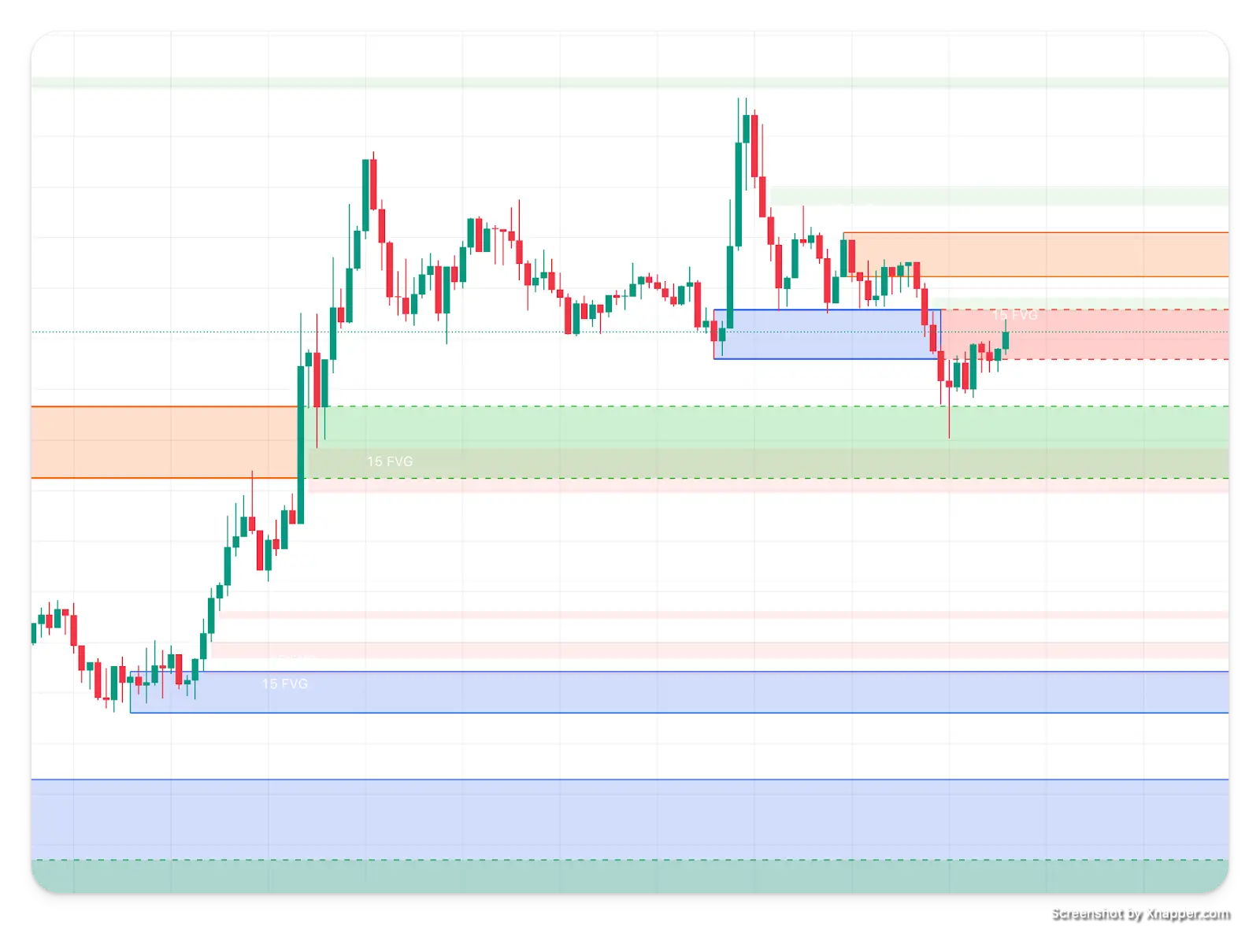

- Fair Value Gaps (FVGs): These are price gaps that appear to be "unfilled" and may represent areas where smart money is accumulating or distributing assets.

- Order Blocks (OBs): These are concentrated areas of buying or selling activity identified by price congestion or large volume spikes. Identifying OBs can help traders anticipate potential support or resistance levels.

Manipulation Scenarios

- Pump and Dump Methods: These schemes involve artificially inflating the price of an asset (often through social media hype or fake news) before dumping it on unsuspecting buyers.

- False Breakouts: This tactic involves placing large orders (often during consolidation phases) to create a false impression of high buying or selling pressure through the range, manipulating prices in the desired direction of professionals' interest.

- Wash Trading: This involves creating artificial trading volume by buying and selling an asset back and forth between controlled accounts, falsely inflating the asset's perceived demand.

Advanced Information And Indicators

- Smart Money Index (SMI): This index is based on the trading behavior of experienced traders and investors, who are often considered smart money participants, stating that this type of trader tends to differ from those of less experienced retail traders.

- Analysis of The Commitments of Traders (COT) report: It provides information about the trading positions among different market participants in the futures and options markets. In the world of crypto trading where more institutions are entering each new day, it is a tool to consider for a broader analysis. It is issued on a weekly basis by the Commodity Futures Trading Commission (CFTC).

- On-chain data and crypto wallets: Analysing these holding wallets is a method to seek coins attracting institutional interest, potentially signaling confidence in a new crypto asset. Also, studying the on-chain data may give traders insights into when there is liquidity and when not in exchanges. Low liquidity suggests investors are expecting to hold assets for the long term, so the market could be bullish. Otherwise, bearish.

Advantages And Disadvantages of SMC Indicators

The simplicity of Smart Money Concepts could seem easy to apply with absolute advantages. However, crypto markets can be more tricky than conventional markets, so SMC traders must be aware of the disadvantages of a very simplistic approach.

What are the advantages?

- Clean charts and setups: allowing a less confusing environment and letting to concentrate on the pure price action.

- Deep evaluation of the overall market structure: footprint charts and order block analysis will provide SMC traders with a better comprehension of market movements. In the same way, they will keep tracking the path of professional traders.

- Fundamental Analysis integration with charting analysis: the nature of Smart Money trading automatically integrates fundamental analysis with charting analysis, which gives this method a versatile application suitable across scalping, day trading, swing trading, and long-term investment.

What are the disadvantages?

- Lack of confirmation methods: since SMC does not rely on technical indicators, its confirmation methods could be naturally limited.

- Inexperienced traders could face a lot of false signals: the learning curve of SMC trading can be overwhelming for novices. Concepts like Order Flow may lead to misinterpretation and taking false signals, most of all during volatile seasons.

Smart Money Vs. Technical Indicators

By now, we have explored the Smart Money concepts from the viewpoint of not using technical indicators.

But, is it incompatible? No. Smart Money trading may, in fact, make advanced use of volume indicators, for example:

- Volume Profile: for SMC readings of the market, high-volume zones at support levels might indicate strong buying interest, while high-volume zones at resistance levels might suggest selling pressure. This can strengthen the validity of Supply and Demand Zones identified through price action analysis.

- Delta Volume: this volume indicator can be used to gauge the underlying buying or selling pressure behind price movements. Also, this can be helpful in determining potential breakouts or reversals with SMC analysis of price action and market structure.

- VWAP (Volume-Weighted Average Price): This can be helpful in conjunction with SMC analysis to identify areas of support or resistance and potential trend changes.

Confirming signals with other indicators like RSI and MACD

- Relative Strength Index with SMC: the RSI oscillator can be used for confirming demand and supply zones based on overbought and oversold indications.

- MACD: MACD stands out as a trend indicator. This tool with SMC analysis could help anticipate potential trend shifts with high accuracy.

Conclusion and call to action

We have addressed Smart Money trading from the viewpoint of indicators and have learned that despite this method does not rely on technical tools, is totally compatible with them and especially with volume.

Smart Money offers a simple framework that can be enhanced by incorporating fundamental research and market scanning.

Altrady is an excellent crypto platform to start scanning the market and testing SMC with a variety of technical tools with a free trial account on paper trading.

Catalin is the co-founder of Altrady. With a background in Marketing, Business Development & Software Development. With more than 15 years of experience working in Startups or large corporations.